tax sheltered annuity limits 2021

Kaiser Permanente Tax Sheltered Annuity Plan This plan helps you build retirement savings while lowering your current taxable income. The limit on catch-up contributions to a 401 k plan a 403 b tax-sheltered annuity or a 457 b eligible deferred compensation plan for persons age 50 and older is.

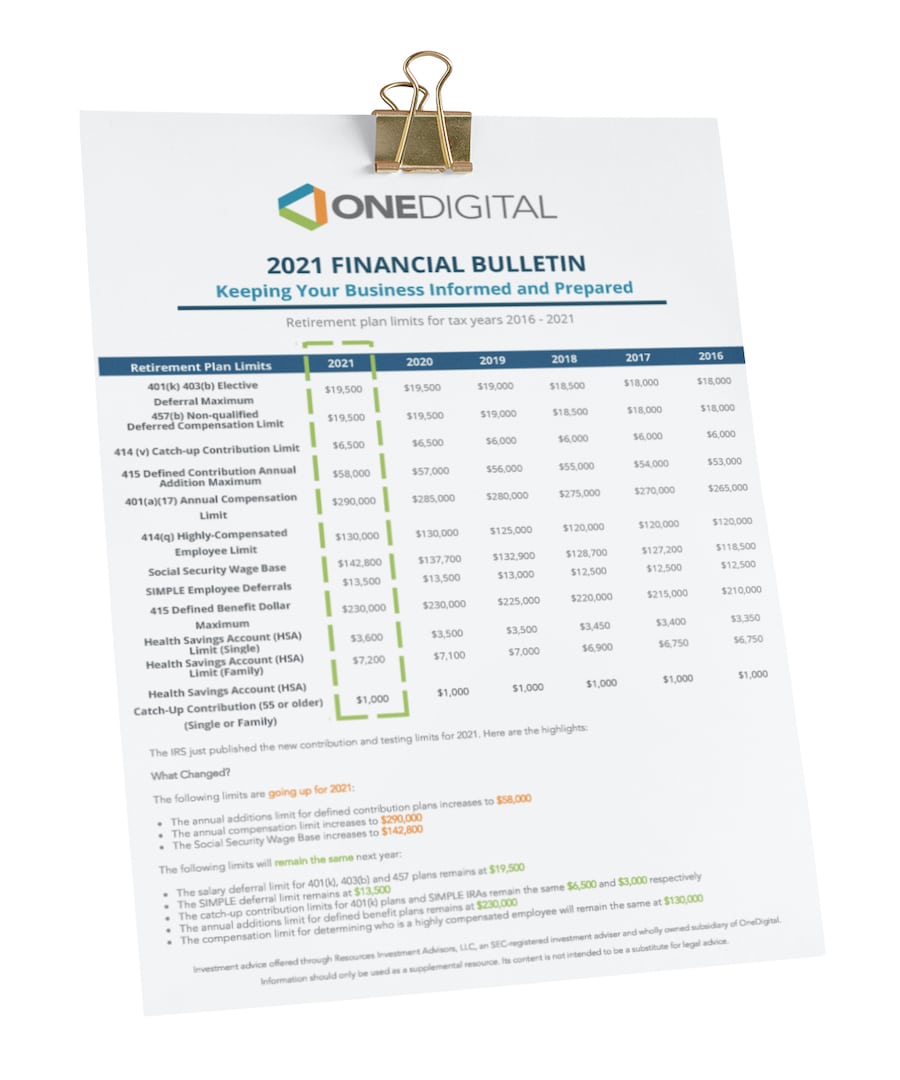

2021 Irs Retirement Plan Contribution Limits Tcg A Hub International Company

The IRS recently announced the 2021 contribution limits for the UW Tax-Sheltered Annuity TSA 403 b Program and the Wisconsin Deferred Compensation WDC 457 Program.

. You can also choose Roth after-tax contributions or a. The limit on elective deferrals Voluntary Tax-Sheltered Annuities remains unchanged at 19500 for 2021. This is a two-year lag so more.

The 2021 Form W-2 includes. Diversity Equity. The Form W-2 reflects wages paid by warrantsdirect deposit payments issued during the 2021 tax year regardless of the pay period wages were earned.

For example FY 2021 Income Limits are calculated using 2014-2018 5-year American Community Survey ACS data and one-year 2017 data where possible. CALIFORNIA STATE UNIVERISITY CSU TAX SHELTERED ANNUITY TSA 403b PROGRAM STATE DEFERRED. If youre 50 or older you can.

2021 INTERN AL REVENUE CODE IRC LIMITS AND COMPARISON CHART. Plan a supplemental plan a tax-sheltered annuity TSA or simply a 403b plan. For State Employees Civil Service Board.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. 2021 Income and Rent Limits. 2021 Income Limits and Maximum Rents.

Contribution Limits The maximum amount you can contribute to a 403 b plan from your salary for 2022 is 20500 up from 19500 in 2021. Home- CTCAC- Low-Income Housing Tax Credit Programs- 2021 Income and Rent Limits. A TDA plan is an employer-sponsored Defined Contribution retirement plan to which you can contribute a.

The age 50 or older catch-up provision remains unchanged at 6500 for 2021.

2021 Retirement Plan Contribution Limits Onedigital

2021 Retirement Plan Contribution Limits

Tax Sheltered Annuity Faqs Employee Benefits

Qualified Vs Non Qualified Annuities Taxation And Distribution

Tax Sheltered Annuity A Term That Should Die Educator Fi

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Publication 590 A 2021 Contributions To Individual Retirement Arrangements Iras Internal Revenue Service

403 B Tax Sheltered Annuity Plans Renton School District 403

22 P 008 Deferred Compensation And Tax Sheltered Annuity Limits For Calendar Year 2022 November 30 Informational Messages And Circulars Kansas Department Of Administration

403 B Tax Sheltered Annuity Plans Renton School District 403

Tax Sheltered Annuity A Term That Should Die Educator Fi

Retirement Plan Maximum Contributions And Tax Deductions

Withdrawing Money From An Annuity How To Avoid Penalties

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

2020 2021 Utsaver Retirement Plans The Best Value By Ut System Office Of Employee Benefits Issuu

Tax Benefits Of Retirement Accounts Comparing 401 K S 403 B S And Iras Turbotax Tax Tips Videos

Sec 457 Government Plan Distributions Compared To 401 K Distributions

:max_bytes(150000):strip_icc():gifv()/Safe-Retirement-Withdrawal-Rate-57a521625f9b58974aa2b94a.jpg)